Structured settlements offer flexible, long-term compensation for complex injury cases involving ongoing medical needs, providing a series of payments over time to manage expenses. Lump sum payments deliver immediate financial relief but may not cover all damages and could limit future claims. Maximizing injury compensation requires strategic planning, considering structured settlements or lump sums based on individual circumstances like property damage or medical malpractice.

When facing an injury claim, understanding your compensation options is crucial. This article delves into the world of structured settlements versus lump-sum payments, offering a comprehensive guide to help you navigate these complex choices. We explore the benefits and drawbacks of each approach, focusing on maximizing injury compensation. By examining various strategies, individuals can make informed decisions, ensuring they receive fair and optimal rewards for their suffering.

- Understanding Structured Settlements: A Comprehensive Guide

- Lump Sum Injury Compensation: Pros and Cons Unveiled

- Maximizing Injury Compensation: Strategies for Fair Rewards

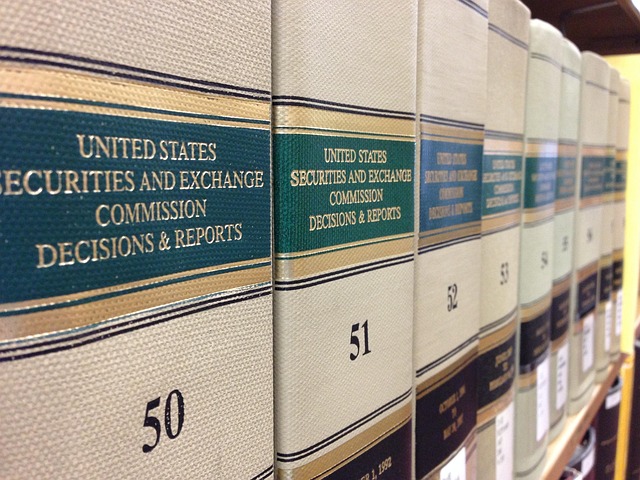

Understanding Structured Settlements: A Comprehensive Guide

Structured settlements offer a unique approach to receiving injury compensation, providing a structured payout over time rather than a single lump sum. This method ensures that victims receive their maximum injury compensation in a way that accommodates their changing financial needs and medical conditions. By breaking down the award into manageable installments, individuals can plan for future expenses related to ongoing treatments, rehabilitation, and daily living costs.

This alternative to a lump-sum payment is particularly beneficial in cases involving long-term injuries or conditions requiring continuous care. For instance, settlements structured for defective product liability claims or partnership disputes ensure that victims are supported financially throughout their recovery process. This proactive approach to compensation management allows individuals to focus on their well-being and rehabilitation without the immediate financial burden of a large, one-time payment.

Lump Sum Injury Compensation: Pros and Cons Unveiled

Lump Sum Injury Compensation offers a straightforward approach to personal injury claims, providing an immediate and fixed amount to settle all associated costs and losses. This method is often appealing as it offers a swift resolution, allowing individuals to access their maximum injury compensation faster. It’s particularly advantageous in cases where future medical expenses are uncertain or when the claimant prefers a quick financial turnaround.

However, there are potential drawbacks. A lump sum might not always cover all aspects of an individual’s recovery journey, especially in complex cases with ongoing treatment needs. Moreover, accepting this type of compensation may limit future options for additional claims related to the same incident, as many insurance policies have specific clauses regarding settlement and subrogation. This is particularly relevant in business litigation involving insurance coverage disputes, where a lump sum could impact an entity’s overall financial strategy and risk management.

Maximizing Injury Compensation: Strategies for Fair Rewards

Maximizing injury compensation is a crucial aspect of ensuring that victims receive fair and adequate rewards for their sufferings. When navigating property damage claims or medical malpractice cases, understanding various compensation options is essential. Structured settlements offer a predictable series of payments over time, providing stability and allowing individuals to budget for future needs related to their injuries. This method can be particularly beneficial in long-term cases where the full extent of damages may not be immediately apparent.

In contrast, a lump sum payment provides immediate access to all compensation, enabling victims to cover immediate expenses, invest for the future, or settle associated partnerships disputes efficiently. While this approach offers liquidity, it may not always reflect the true value of the victim’s claim, especially in complex cases involving extensive medical treatments and ongoing care needs. Thus, strategic planning is key to securing maximum injury compensation tailored to individual circumstances.

When seeking fair rewards for injury compensation, understanding the nuances of structured settlements versus lump sum payments is crucial. Both options offer unique advantages and considerations, with structured settlements providing predictable income streams and lump sum payments offering immediate financial freedom. By weighing the pros and cons of each approach, individuals can make informed decisions to maximize their maximum injury compensation and secure their financial future. This knowledge empowers them to navigate the complex landscape of personal injury claims effectively.